Table Of Content

Greg McBride is a CFA charterholder with more than a quarter-century of experience in personal finance, including consumer lending prior to coming to Bankrate. Through Bankrate.com's Money Makeover series, he helped consumers plan for retirement, manage debt and develop appropriate investment allocations. At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. The average 15-year fixed mortgage APR is 6.83%, according to Bankrate's latest survey of the nation's largest mortgage lenders.

What do you need to refinance your home?

Before joining Bankrate in 2020, I spent more than 20 years writing about real estate and the economy for the Palm Beach Post and the South Florida Business Journal. I’ve had a front-row seat for two housing booms and a housing bust. I’ve twice won gold awards from the National Association of Real Estate Editors, and since 2017 I’ve served on the nonprofit’s board of directors.

Mortgage Interest Rates Forecast

Adjustable-rate mortgages are typically cheaper than fixed-rate mortgages during the first few years, but have the potential to cost you a lot more in the long run. Qualifying for a refinance is the same as qualifying for a purchase home loan, as lenders want to make sure you can afford the payments and that you will make them on time per your contract. Although each lender has different requirements, generally all lenders will look at your credit score, debt-to-income ratio (DTI), income and home equity. Unlike an interest rate, however, it includes other charges or fees (such as mortgage insurance, most closing costs, points and loan origination fees) to reflect the total cost of the loan. The lengthy 30-year term allows you to spread out your payments over a long period of time, meaning you can keep your monthly payments lower and more manageable.

Your California privacy choices

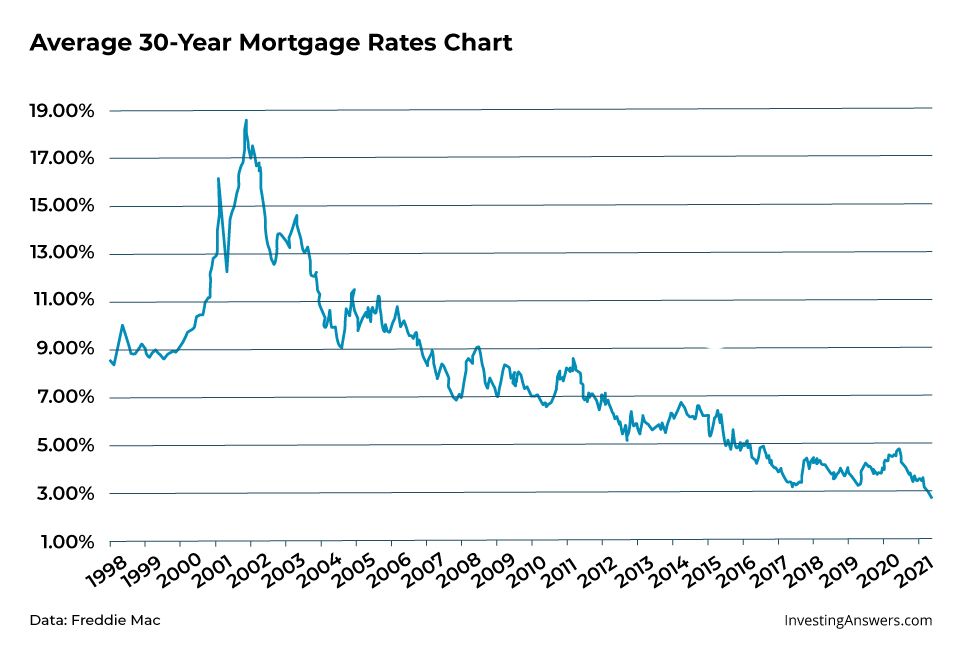

However, the Federal Reserve has indicated it will begin cutting rates in 2024 as the economy cools and inflation continues to fall. Assuming these trends hold steady, you can expect to see lower mortgage rates in 2024. But these predictions are based on assumptions that may or may not pan out. Increases or decreases in 10-year Treasury yields directly influence 30- and 15-year mortgage rates. Currently, the Federal Reserve is actively buying 10-year Treasury notes, which increases the demand for these securities and drives their price up and yields down. So, our near record low mortgage rates are directly tied to the Federal Reserve Board's response to COVID-19 in efforts to keep financial markets open.

What is the best type of mortgage loan?

However, you’ll likely end up with a slightly higher interest rate—and you’ll be paying interest on your closing costs. The rates and monthly payments shown are based on a loan amount of $940,000 and a down payment of at least 25%. Plus, see a jumbo estimated monthly payment and APR example. The rates and monthly payments shown are based on a loan amount of $270,072 and no down payment. The rates and monthly payments shown are based on a loan amount of $270,019 and a down payment of at least 3.5%. You'll almost certainly end up with a different interest rate than you'll see quoted on mortgage lenders’ websites.

First-time homebuyer programs in California

Is The Housing Market Going To Crash? - Bankrate.com

Is The Housing Market Going To Crash?.

Posted: Sun, 21 Apr 2024 07:00:00 GMT [source]

Money can't buy happiness, but it can usually buy a lower mortgage interest rate. You pay a fee when you get the loan, and your lender permanently reduces your interest rate. Buying points could be a good strategy if you plan to own the home for a long time. Whether you're looking to buy or refinance, our daily rates pieces will help you stay up to date on the market's average rates. High-yield savings accounts often pay much higher interest than conventional savings accounts.

Once you’ve selected your lender, you should ask your loan officer about the options you have to lock in a rate. Mortgage rate locks usually last between 30 and 60 days, and they exist to give you a guarantee that the rate your lender offered you will still be available when you actually close on the loan. If your loan doesn’t close before your rate lock expires, you should expect to pay a rate lock extension fee. If you don’t lock in right away, a mortgage lender might give you a period of time—such as 30 days—to request a lock, or you might be able to wait until just before closing on the home. Another important consideration in this market is determining how long you plan to stay in the home. People who are buying their “forever home” have less to fear if the market reverses as they can ride the wave of ups and downs.

If you plan to stay in the home for an extended period, getting the lowest mortgage rate can be more important than paying the lowest closing costs. The average APR for a 30-year fixed refinance loan increased to 7.82% from 7.78% yesterday. Meanwhile, the average APR on a 15-year fixed refinance mortgage is 7.01%.

Pros and cons of a 30-year mortgage

That’s a startling number in a nation where around five million homes sell annually in more normal times — most of those to people who already own. We offer a wide range of loan options beyond the scope of this calculator, which is designed to provide results for the most popular loan scenarios. If you have flexible options, try lowering your purchase price, changing your down payment amount or entering a different ZIP code. Mortgage rates are expected to fall as inflation slows, but because inflation readings have been sticky in recent months, it will likely be a while before we see rates drop substantially. In the meantime, some buyers are going ahead and purchasing homes, in spite of high rates.

With fixed‑rate mortgages, the interest rate remains the same for the entire term of the loan. With an adjustable-rate mortgage (ARM), the interest rate may change periodically during the life of the loan. You may get a lower interest rate for the initial portion of the loan term, but your monthly payment may fluctuate as the result of any interest rate changes. The exact lock period may vary, but typically you can lock in a mortgage rate for 30 to 60 days. If the rate lock expires, you’re no longer guaranteed the locked-in rate unless the lender agrees to extend it.

The Federal Reserve, which hiked rates throughout much of 2022 and 2023, has indicated it will begin cutting rates in 2024 amid falling inflation and a slowing economy. To cut costs, that could mean some buyers would need to move further away from higher-priced cities into more affordable metros. For others, it could mean downsizing, or foregoing amenities or important contingencies like a home inspection.

No comments:

Post a Comment